Uniquely Indian, undeniably global asset management.

360 ONE Asset Management is an India-focussed, global asset management firm.

360 ONE Overnight Fund

|

Product Downloads

Application Form

Scheme Information Document

Key Information Memorandum

Click here to Invest Now

Type of Scheme:

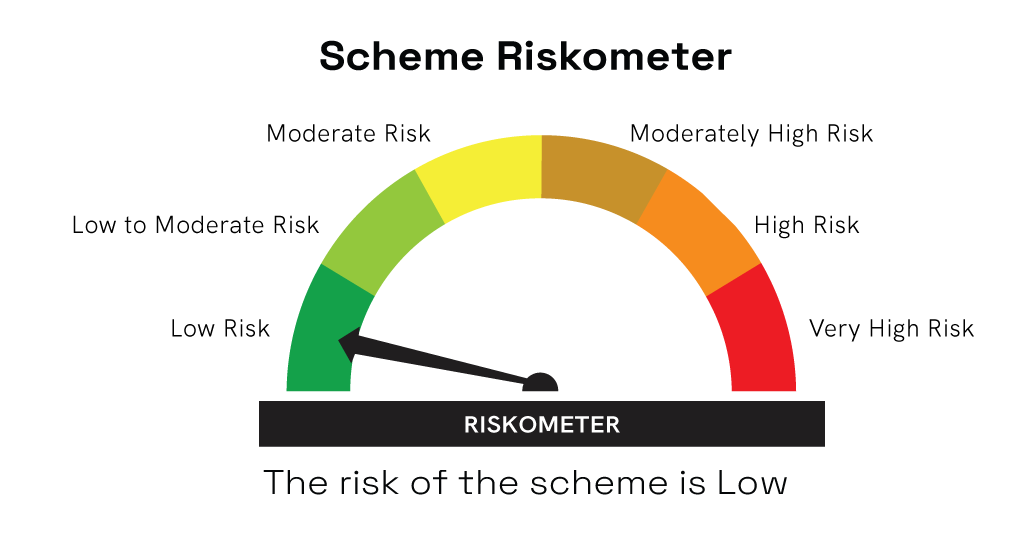

An open-ended debt scheme investing in overnight securities. A relatively low interest risk & relatively low credit risk.

Investment Objective:

The investment objective of the Scheme is to generate reasonable returns commensurate with low risk and providing high level of liquidity, through investments made in debt and money market securities having maturity of 1 business day. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved.

Benchmark:

NIFTY 1D Rate Index

Asset Allocation:

The investment policies of the Scheme shall be as per SEBI (Mutual Funds) Regulations, 1996, and within the following guidelines. Under normal market circumstances, the investment range would be as follows:

| Instruments | Indicative Allocation (% of Total assets) | Risk Profile | |

|---|---|---|---|

| Minimum | Maximum | ||

| Overnight Securities # | 0% | 100% | Low |

#Overnight Securities: Debt and money market instruments with overnight interest rate risk such as debt instruments with one business day residual maturity or where the interest rate is reset on a daily basis. Overnight securities include synthetic overnight positions such as reverse repo/tri-party repo transactions where the interest rate is reset every business day.

Plans / Options for Investment:

I. PLAN:

Regular Plan and Direct Plan

II. OPTION

The Scheme has the following Options under each of above plans

• Growth Option: This option is suitable for investors who are not looking for current income but who invest only with the intention of capital appreciation.

• Income Distribution cum Capital Withdrawal (IDCW) Option: This option is suitable for investors seeking income through IDCW declared by the Scheme. Under this Option, the Scheme will endeavor to declare IDCW from time to time. The IDCW shall be dependent on the availability of distributable surplus. The IDCW can be distributed out of investors capital (equalization reserve), which is part of sale price that represents realized gains

The Income Distribution cum Capital Withdrawal (IDCW) Option has the following Facilities:

o Re-investment of Income Distribution cum Capital Withdrawal option (IDCW Reinvestment) Facility (available for Daily, Weekly frequency)

o Payout of Income Distribution cum Capital Withdrawal option (IDCW Payout) Facility (available for Weekly frequency)

Minimum Application Amount:

New Purchase – Rs. 5,000 and in multiples of Rs. 1 thereafter.

Additional purchase - Rs. 1000 and in multiples of Rs. 1 thereafter

Systematic Investment Plan (SIP)

• Weekly Option - Rs. 1000 per instalment for a minimum period of 6 weeks Default day triggered every Tuesday

• Fortnightly Option- Rs. 1000 per instalment for a minimum period of 6 fortnights, triggered on 2nd & 16th of every month

• Monthly option - Rs. 1000 per month for a minimum period of 6 months.

• Quarterly Option – Rs.1500 per quarter for a minimum period of 4 quarters.

Note: Weekly and Fortnightly SIP frequencies are not available on BSE STAR MF platform.

Load Structure:

Entry Load: NIL

Exit Load: NIL

Fund Manager:

Mr. Milan Mody

Monthly disclosure document - December 2025

Scheme performance - January 2026

Click here to Invest Now

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.